Investing can be daunting for beginners. Investiit.com Tips is here to help. This guide offers essential strategies for successful investing. We’ll explore diversification, long-term planning, and emotional discipline. Let’s dive into smart investing with Investiit.com Tips.

The Importance of Diversification: Don’t Put All Your Eggs in One Basket

Diversification is a crucial strategy for smart investing. It involves spreading your investments across different assets and sectors. This approach helps to reduce risk and protect your portfolio from major losses.

What is Diversification?

Diversification is a key investment strategy. It involves spreading investments across various assets. This approach helps manage risk effectively. Investiit.com Tips recommends diversification for all investors.

Why Diversification Matters?

Diversification protects your portfolio. It reduces the impact of poor-performing investments. A diverse portfolio is more stable. Investiit.com Tips emphasizes diversification for long-term success.

Practical Tips for Diversifying Your Portfolio

- Invest in different asset classes

- Spread investments across various industries

- Consider international markets

- Use mutual funds or ETFs for instant diversification

- Regularly review and rebalance your portfolio

- Consider alternative investments

The Risk of Overconcentration: Avoiding the Enron Effect

Overconcentration in a single investment can be dangerous. The Enron scandal serves as a stark reminder of this risk. Many employees lost their life savings when the company collapsed. To avoid this, it’s important to limit your exposure to any single company or sector.

Lessons from the Past: The Enron Scandal

The Enron scandal highlights the dangers of overconcentration. Many employees lost their savings. They had invested heavily in company stock. Investiit.com Tips warns against putting all your money in one place.

Avoiding Overconcentration in Your Portfolio

- Limit investment in any single company

- Don’t rely solely on your employer’s stock

- Use index funds for broad market exposure

- Regularly review your portfolio composition

- Seek advice if you’re unsure about concentration levels

- Consider using stop-loss orders

Read This Blog: Iloveloveloveebay.com: What You Need to Know Before Visiting

Playing the Long Game: Patience is Key to Successful Investing

Successful investing often requires a long-term perspective. Market fluctuations are normal and shouldn’t cause panic. By staying invested over time, you can benefit from compound growth. Patience allows you to ride out short-term volatility and focus on long-term gains.

Why Long-Term Investing Works?

Long-term investing offers several benefits. It allows you to ride out market fluctuations. Historically, markets trend upward over time. Investiit.com Tips advocates for a patient approach to investing.

The Power of Compounding

Compounding is a powerful force in investing. It’s the process of earning returns on your returns. Over time, this can significantly grow your wealth. Investiit.com Tips emphasizes starting early to maximize compounding.

Tips for Long-Term Investing Success

- Start investing as early as possible

- Consistently contribute to your investments

- Reinvest dividends and interest

- Avoid frequent trading

- Stay focused on your long-term goals

- Consider dollar-cost averaging

The Importance of Research: Knowledge is Power

Thorough research is essential before making any investment decision. Understanding the assets you’re investing in can help you make informed choices. Good research involves analyzing financial reports, industry trends, and economic indicators.

Conduct Thorough Research Before Investing

Research is crucial for informed investing. Understand the assets you’re investing in. Know the risks and potential rewards. Investiit.com Tips stresses the importance of due diligence.

Sources of Investment Research

- Financial news websites

- Company annual reports

- Industry analysis reports

- Government economic data

- Investment research platforms

- Financial advisors and professionals

Avoiding Investment Pitfalls

- Be wary of “hot tips” or get-rich-quick schemes

- Don’t invest in something you don’t understand

- Avoid making decisions based on emotions

- Be cautious of high-pressure sales tactics

- Always read the fine print

- Consider the impact of fees and taxes

Read This Blog: Cursed-Memes.com Business: Navigating the Weird World of Unsettling Humor

Emotional Discipline: Keeping Your Cool in the Market

Emotions can greatly influence investment decisions, often negatively. Fear and greed can lead to poor choices like panic selling or impulsive buying. Maintaining emotional discipline is crucial for long-term success.

The Role of Emotions in Investing

Emotions can significantly impact investment decisions. Fear and greed often lead to poor choices. Investiit.com Tips emphasizes the importance of emotional control in investing.

Common Emotional Pitfalls

- Panic selling during market downturns

- FOMO (Fear of Missing Out) investing

- Overconfidence in investment abilities

- Attachment to losing investments

- Impatience with slow-growing investments

- Anxiety over short-term market fluctuations

Strategies for Maintaining Emotional Discipline

- Develop a solid investment plan and stick to it

- Set realistic expectations for returns

- Avoid constantly checking your portfolio

- Practice mindfulness and stress management

- Seek support from a financial advisor if needed

- Educate yourself about market cycles and volatility

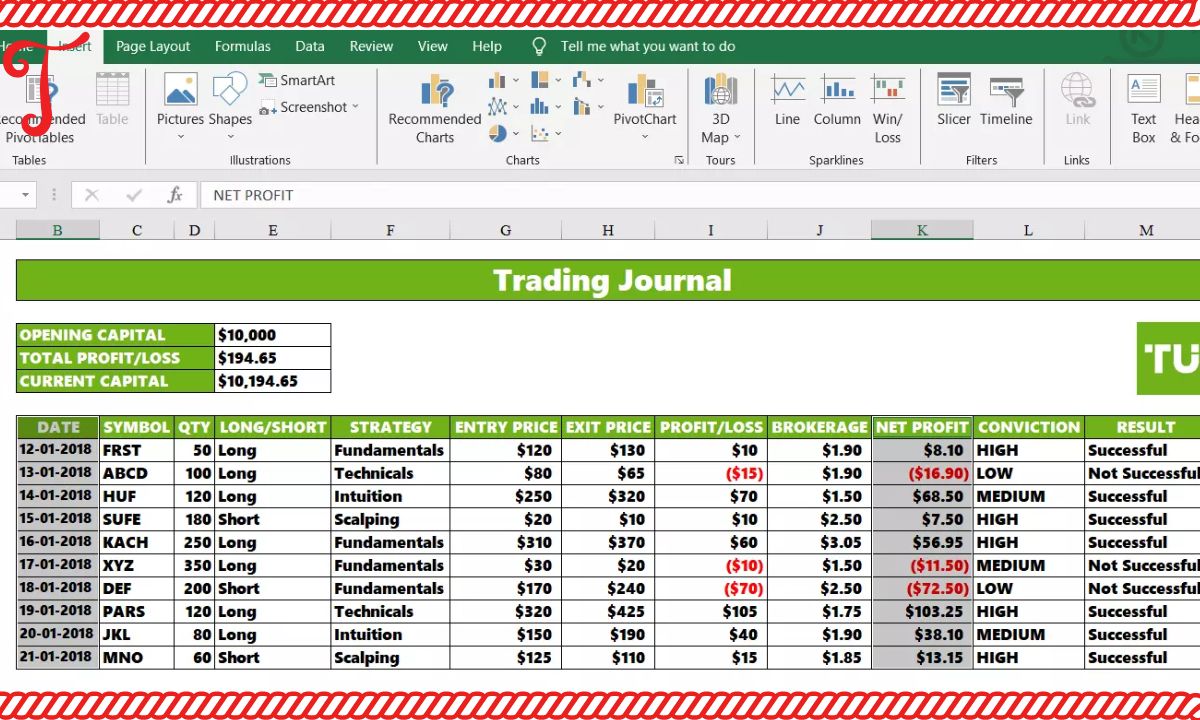

Learning from Mistakes: Every Investor Stumbles

Mistakes are an inevitable part of the investing journey. However, they provide valuable learning opportunities. Analyzing your errors can help improve your future investment decisions. It’s important to view mistakes as stepping stones to becoming a better investor.

The Value of Experience

Mistakes are inevitable in investing. They provide valuable learning opportunities. Investiit.com Tips encourages investors to reflect on their errors.

Common Investment Mistakes and How to Avoid Them

- Not starting early enough

- Failing to diversify adequately

- Trying to time the market

- Neglecting to rebalance the portfolio

- Ignoring fees and taxes

- Chasing past performance

Moving Forward After a Loss

- Analyze what went wrong

- Adjust your strategy accordingly

- Don’t let one loss discourage you

- Remember that losses are part of investing

- Focus on your long-term goals

- Consider seeking professional advice

Continuous Learning: Staying Informed in a Changing Market

The investment world is constantly evolving. Staying informed about market trends and economic changes is crucial. Continuous learning helps you adapt your strategy to new conditions.

The Importance of Ongoing Education

The investment world is constantly evolving. Staying informed is crucial for success. Investiit.com Tips encourages continuous learning for all investors.

Resources for Investment Education

- Online courses and webinars

- Investment books and magazines

- Financial podcasts

- Investor forums and communities

- Professional development seminars

- Financial advisor consultations

Adapting to Market Changes

- Stay updated on economic news

- Be open to new investment opportunities

- Regularly review and adjust your strategy

- Learn about emerging technologies in finance

- Seek professional advice when needed

- Monitor global events that may impact markets

Frequently Asked Questions

How much money do I need to start investing?

You can start with any amount. Many platforms allow small investments. Investiit.com Tips recommends starting with what you can afford.

Is it too late to start investing in my 40s or 50s?

It’s never too late to start. While starting early is ideal, later investing can still be beneficial. Investiit.com Tips encourages investors of all ages.

How often should I check my investments?

Avoid checking too frequently. Monthly or quarterly reviews are often sufficient. Investiit.com Tips suggests focusing on long-term performance.

Should I invest in individual stocks or mutual funds?

This depends on your goals and risk tolerance. Mutual funds offer diversification. Individual stocks require more research. Investiit.com Tips recommends a balanced approach.

How do I know if I’m ready to start investing?

If you have a stable income, an emergency fund, and manageable debt, you may be ready. Investiit.com Tips suggests starting small and learning as you go.

Conclusion

Investing is a journey of continuous learning and growth. Investiit.com Tips provides valuable guidance for both new and experienced investors. Remember to diversify, think long-term, and maintain emotional discipline. Stay informed and adapt to market changes.

With patience and persistence, you can build a successful investment portfolio. Investiit.com Tips is here to support you on your investment journey. Trust in the process, stay committed to your goals and watch your wealth grow over time. Happy investing!

Sahar is a talented content writer and digital marketer with expertise in SEO, social media management, and online marketing. She excels at creating impactful, data-driven content to help businesses connect with their target audience and achieve measurable outcomes.